BTC Price Prediction: Analyzing the Path to $100,000

#BTC

- Technical Foundation: Bitcoin is trading robustly above its key 20-day moving average and within a bullish zone of its Bollinger Bands, indicating strong underlying momentum and a clear next resistance level near $96,573.

- Institutional Catalyst: Major actions by asset managers like BlackRock and Vanguard demonstrate sustained institutional demand, providing a fundamental bid that supports higher price levels.

- Evolving Narrative: Regulatory comments, while cautious, are increasingly distinguishing Bitcoin from the broader crypto sector, granting it a legitimacy that reduces investment friction and supports long-term valuation models.

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

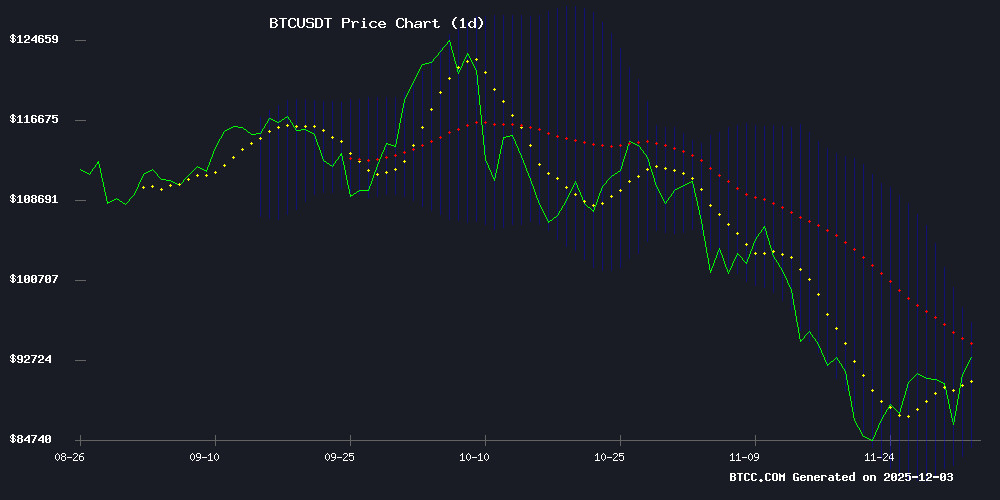

As of December 3, 2025, Bitcoin is trading at, firmly above its 20-day moving average of 90,257.99. This positioning above a key short-term trend indicator suggests underlying strength. The MACD reading of 3,501.92, though below its signal line, indicates momentum is present. Notably, the price is trading between the middle (90,257.99) and upper (96,573.18) Bollinger Bands, which typically signals a period of upward momentum without being overbought. 'The consolidation above the 20-day MA, coupled with room to run to the upper Bollinger Band, paints a technically constructive picture for Bitcoin,' says BTCC financial analyst Robert.

Market Sentiment: Institutional Moves and Regulatory Clarity Fuel Optimism

Current headlines reflect a potent mix of institutional adoption and evolving regulatory perspectives that are buoying market sentiment. Major developments include Vanguard reopening access to bitcoin ETFs and BlackRock's significant transfer of Bitcoin to Coinbase Prime, underscoring robust institutional demand. While regulatory skepticism persists, as noted by former SEC Chair Gensler's comments, his acknowledgment of Bitcoin's unique standing is being interpreted as a form of backhanded legitimacy. 'The narrative is shifting from pure speculation to recognized asset class, driven by these institutional flows and clearer, if cautious, regulatory signals,' observes BTCC financial analyst Robert. Reports from firms like Grayscale forecasting new highs by 2026 further bolster the mid-term bullish outlook.

Factors Influencing BTC’s Price

Former SEC Chief Gensler Maintains Crypto Skepticism but Acknowledges Bitcoin's Standing

Gary Gensler, former SEC chair and current MIT professor, reiterated his cautious stance on cryptocurrencies in a Bloomberg interview. He described most digital assets as speculative instruments lacking intrinsic value, with prices driven primarily by momentum rather than utility. "Many tokens don't offer dividends, real value, or strong use cases," Gensler noted, emphasizing their volatility.

Bitcoin emerged as the exception in Gensler's critique. The ex-regulator singled out BTC and regulated stablecoins as having established trust—a notable concession from one of crypto's most prominent skeptics. This distinction reflects his enforcement approach during 2021-2025, when the SEC targeted unregistered securities while treating Bitcoin as a commodity.

The market has evolved since Gensler's tenure, with major altcoins like ETH and SOL now powering smart contracts and decentralized applications. Yet price swings remain more pronounced than Bitcoin's, particularly among meme coins and newer projects. "Some launch with just a whitepaper," Gensler observed, "then lose 80-90% after the hype fades."

Gensler: Bitcoin Stands Alone in Legitimacy Amid Crypto Speculation

Former SEC Chairman Gary Gensler delivered a stark warning about the cryptocurrency market in a recent Bloomberg interview. While acknowledging Bitcoin's unique position as a commodity-like asset, he characterized most other tokens as speculative ventures lacking fundamental value.

Gensler's remarks underscore a growing regulatory divide. Bitcoin, by his assessment, remains the only digital asset with clear legitimacy—a stance that could shape future policy decisions. Meanwhile, the broader crypto ecosystem continues to grapple with volatility and uncertain regulatory status.

Bitcoin Eyes $93K Amid Short Squeeze as Vanguard Reopens BTC ETF Access

Bitcoin's price surged 6% following Vanguard's decision to allow client access to Bitcoin ETFs, triggering $1.8 billion in BlackRock IBIT volume within two hours. Institutional demand returned with force, propelling BTC toward its $93,000 resistance level.

A cluster of short liquidations near $93K could amplify upside momentum. The market remembers last week's rejection at this level—this time, the combination of institutional inflows and leveraged position unwinding may fuel a decisive breakout.

Bitcoin Rebounds Above $90,000 Amid Regulatory Signals and Market Volatility

Bitcoin surged past $90,000, recovering from recent losses as regulatory developments and institutional activity injected cautious optimism into the market. SEC Chair Paul Atkins' mention of an "innovation exemption" for crypto firms sparked investor interest, though volatility persists across correlated assets.

Equities tied to cryptocurrencies mirrored the turbulence, with American Bitcoin Corp plummeting 51% intraday. The divergence between Bitcoin's resilience and sector-wide fragility underscores the uneven nature of crypto market recoveries.

Grayscale Foresees Bitcoin Surpassing Previous Highs by 2026

Grayscale, a leading digital asset manager, has projected that Bitcoin could reach new all-time highs by 2026, defying the traditional four-year cycle tied to halving events. The firm's analysis suggests that despite recent volatility, Bitcoin's long-term trajectory remains bullish.

Bitcoin's 27% decline from its October peak mirrors typical corrections within broader bull markets, according to Grayscale. The report challenges prevailing market narratives, positioning the cryptocurrency for potential record-breaking performance in the coming years.

CryptoAppsy Launches Multi-Language Trading Assistant for Real-Time Market Data

CryptoAppsy emerges as a nimble solution for cryptocurrency traders navigating volatile markets. The app delivers real-time price updates across thousands of assets—including Bitcoin ($87,412 mentioned in context) and altcoins—with five-second refresh intervals. Its zero-signup design and multilingual support (Turkish/English/Spanish) cater to global users seeking arbitrage opportunities or portfolio alerts.

Key features include a consolidated dashboard displaying exchange data, personalized news feeds tied to holdings, and instant notifications for new coin listings. The application aggregates information from undisclosed global exchanges, though major platforms like Binance and Coinbase are implied market data sources given their dominance.

Early adopters rate the experience 5.0/5, particularly praising its lightweight interface and portfolio management tools supporting multiple currencies. While no specific coins beyond BTC are named in the excerpt, the app's capability to track 'latest altcoins' suggests coverage for trending assets like SOL, MEME, or PEPE that dominate retail trader interest.

Bitcoin Price to Hit Record in 2026, Says Grayscale Report on Trends

Grayscale's latest analysis projects Bitcoin will surpass its previous all-time high by 2026, marking a shift from the traditional 4-year cycle to a 5-year pattern. The report underscores Bitcoin's resilience, noting 35%-75% returns over multi-year horizons despite volatility.

Federal Reserve rate cuts loom as a potential catalyst for Bitcoin's next rally. "We do not believe bitcoin is on the cusp of a prolonged downturn," the report states, highlighting institutional confidence in the asset's long-term trajectory.

BlackRock Moves $142.6M in Bitcoin to Coinbase Prime as IBIT ETF Tops $70B AUM

BlackRock transferred 1,633 BTC ($142.6M) to Coinbase Prime, a move characterized as routine liquidity management for its iShares Bitcoin Trust (IBIT). The fund has become the fastest-growing ETF in history, reaching $70.7B in assets under management in just 341 days since its January 2024 launch.

IBIT now generates $245M in annual fees—surpassing BlackRock’s own S&P ETF—and holds 3% of Bitcoin’s circulating supply. Harvard University’s endowment has allocated $443M to the fund, representing 20% of its U.S. equity exposure.

The Coinbase Prime transfer reflects institutional demand for secure execution infrastructure amid volatile ETF flows. Market observers note such movements are operational rather than bearish signals, as IBIT continues to dominate Bitcoin ETF inflows.

CryptoAppsy Delivers Real-Time Market Intelligence for Traders

CryptoAppsy emerges as a critical tool for cryptocurrency traders navigating volatile markets. The app aggregates real-time pricing data across thousands of assets—from Bitcoin to emerging altcoins—with updates every five seconds. Its lightweight design supports iOS and Android, offering multilingual functionality in Turkish, English, and Spanish.

Key features include a consolidated dashboard displaying portfolio tracking, personalized news feeds, and instant alerts for newly listed coins. The app’s arbitrage detection capabilities leverage live exchange data, while its alarm system monitors predefined price thresholds. User reviews highlight a 5.0/5 rating for its intuitive interface and reliability during rapid market movements.

Cango Inc. (CANG) Shares Drop 6.9% Despite 60.6% Revenue Surge and Bitcoin Mining Expansion

Cango Inc. delivered robust third-quarter results, with revenue climbing 60.6% to $224.6 million. Bitcoin mining operations proved a key driver, producing 1,930.8 BTC amid 90% mining efficiency. Yet markets reacted skeptically—shares fell 6.9% to $1.35, reflecting profit-taking and uncertainty about sustainability.

The company’s pivot toward crypto mining continues to reshape its financial profile. Operating income reached $43.5 million, though investors remain cautious about capital allocation in volatile markets. Cango’s next-phase ambitions include AI and renewable-powered compute infrastructure, signaling a strategic bet on high-growth tech verticals.

AI Boom Fuels Bitcoin Miner Rally as Tech Synergies Emerge

Bitcoin miners are riding the AI wave, with stocks like IREN and Cipher Mining surging over 300% as investors bet on crossover potential between artificial intelligence and cryptocurrency infrastructure. The computational demands of both fields create natural synergies, though operational complexities remain.

Companies are retooling data centers to accommodate dual-use cases, leveraging excess capacity for machine learning workloads during off-peak mining cycles. This strategic pivot comes as institutional capital floods into AI-adjacent sectors, with crypto miners positioning themselves as infrastructure plays for the digital age.

Will BTC Price Hit 100000?

Based on the current technical setup and prevailing market sentiment, a move toward $100,000 is a plausible near-to-mid-term scenario. Technically, Bitcoin has established a strong foundation above $90,000. The proximity to the upper Bollinger Band at ~$96,573 presents the next immediate target. A decisive break above this level could open a clear path toward the $100,000 psychological benchmark.

Fundamentally, the sentiment is being powered by concrete institutional actions—such as BlackRock's ETF movements and Vanguard's renewed access—rather than just speculation. This provides a more sustainable bid under the market. While volatility should be expected, the convergence of positive technicals and supportive fundamentals suggests the momentum is building for a test of the six-figure threshold.

| Factor | Current Status | Implication for $100K Target |

|---|---|---|

| Price vs. 20-Day MA | Price at 93,523 > MA at 90,258 | Bullish; confirms uptrend |

| Bollinger Band Position | Between Middle & Upper Band | Suggests ongoing upward momentum |

| Key Technical Resistance | Upper Band ~96,573 | Next target before 100,000 |

| Institutional Flow (e.g., BlackRock) | Substantial ETF movements | Provides strong buying pressure |

| Regulatory Sentiment | Bitcoin's standing acknowledged | Reduces systemic risk perception |

'The pieces are aligning. The technical roadmaps shows a clear level to watch near $96,500, and the institutional narrative provides the fuel. A break above the December high could accelerate the move toward $100,000,' concludes BTCC financial analyst Robert.